Our Solutions

Governance | Stewardship | Sustainability

Our Solutions

Governance | Stewardship | Sustainability

Our Solutions

Governance | Stewardship | Sustainability

The core of our services is operationalizing governance, stewardship and sustainability.

As an investor-focused firm, our team provides expertise in the design and execution of strategies for evaluating environmental, social and corporate governance (ESG) factors in investment decision-making, and supports engagement between investors and their portfolio companies.

Institutional Investors

Asset Managers

- Stewardship diagnostics - benchmarking and evaluation

- ESG Integration – reinforcing strategy and decision-making, ESG KPIs, ESMS, tools and templates, implementation support

- Stewardship capacity-building

- Investment origination support – ESG data and analytics, prospect sustainability due diligence and investment decision-making support

- Portfolio engagement - ESG data and analytics, investee sustainability assessment, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Stewardship reporting

Asset Owners

- Stewardship mandate formulation –

benchmarking and evaluation - Asset manager stewardship reporting analytics

- Stewardship and LPAC capacity-building

- Asset manager selection and due diligence – manager ESG mandate reviews

- Asset manager ESG integration assessment

- Thematic portfolio engagements

Impact Investors

- Impact strategy diagnostics – benchmarking and evaluation

- Impact strategy integration – reinforcing strategy and decision-making, ESG KPIs, ESMS, tools and templates, implementation support

- Capacity-building

- Investment origination support – ESG data and analytics, prospect sustainability due diligence and investment decision-making support

- Portfolio engagement - ESG data and analytics, impact evaluation, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Stewardship/Impact Principles verification and reporting

Development Finance Institutions

- ESG integration tools and frameworks – designing and improving specialized corporate governance and E&S methodologies and toolkits tailored to particular regions, markets, industries, ownership patterns and size and stage of company development

- ESG capacity-building – for investment and ESG professionals, board nominees and LPAC appointees

- CG and E&S thematic research

- Investment origination support – ESG data and analytics, sustainability due diligence and investment decision support to direct and fund investments

- Portfolio engagement - ESG data and analytics, investee sustainability assessment, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Fund manager stewardship due diligence and reporting

- ESG advisory services support – technical assistance program design, management and implementation on ESG, corporate climate governance, climate finance and related themes

Institutional Investors

Asset Managers

- Stewardship diagnostics - benchmarking and evaluation

- ESG Integration – reinforcing strategy and decision-making, ESG KPIs, ESMS, tools and templates, implementation support

- Stewardship capacity-building

- Investment origination support – ESG data and analytics, prospect sustainability due diligence and investment decision-making support

- Portfolio engagement - ESG data and analytics, investee sustainability assessment, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Stewardship reporting

Asset Owners

- Stewardship mandate formulation –

benchmarking and evaluation - Asset manager stewardship reporting analytics

- Stewardship and LPAC capacity-building

- Asset manager selection and due diligence – manager ESG mandate reviews

- Asset manager ESG integration assessment

- Thematic portfolio engagements

Impact Investors

- Impact strategy diagnostics – benchmarking and evaluation

- Impact strategy integration – reinforcing strategy and decision-making, ESG KPIs, ESMS, tools and templates, implementation support

- Capacity-building

- Investment origination support – ESG data and analytics, prospect sustainability due diligence and investment decision-making support

- Portfolio engagement - ESG data and analytics, impact evaluation, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Stewardship/Impact Principles verification and reporting

Development Finance Institutions

- ESG integration tools and frameworks – designing and improving specialized corporate governance and E&S methodologies and toolkits tailored to particular regions, markets, industries, ownership patterns and size and stage of company development

- ESG capacity-building – for investment and ESG professionals, board nominees and LPAC appointees

- CG and E&S thematic research

- Investment origination support – ESG data and analytics, sustainability due diligence and investment decision support to direct and fund investments

- Portfolio engagement - ESG data and analytics, investee sustainability assessment, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Fund manager stewardship due diligence and reporting

- ESG advisory services support – technical assistance program design, management and implementation on ESG, corporate climate governance, climate finance and related themes

Solutions and Products for Institutional Investors

Lenders and Underwriters

- Sustainability diagnostics – benchmarking and evaluation

- Sustainability integration – reinforcing strategy and decision-making, ESG KPIs, ESMS, tools and templates, implementation support

- ESG for high-impact lending (clean energy, process efficiency, women-led businesses), analysis of sectoral exposure to key E&S risks (particularly climate change and water availability)

- Sustainability capacity-building

- Lending origination engagement – ESG data and analytics, prospect sustainability due diligence and investment decision-making support

- Portfolio borrower engagement - ESG data and analytics, borrower sustainability due diligence, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Sustainability reporting, including TCFD compliance

Lenders and Underwriters

- Sustainability diagnostics – benchmarking and evaluation

- Sustainability integration – reinforcing strategy and decision-making, ESG KPIs, ESMS, tools and templates, implementation support

- ESG for high-impact lending (clean energy, process efficiency, women-led businesses), analysis of sectoral exposure to key E&S risks (particularly climate change and water availability)

- Sustainability capacity-building

- Lending origination engagement – ESG data and analytics, prospect sustainability due diligence and investment decision-making support

- Portfolio borrower engagement - ESG data and analytics, borrower sustainability due diligence, direct engagement with portfolio companies, including thematic, company-specific and cross-portfolio dialogue

- Sustainability reporting, including TCFD compliance

Policy Makers

- Policy support on governance, stewardship and sustainability from the practitioner’s perspective

- CG and ESG thematic research

- Support in the formulation of governance, stewardship and sustainability standards and codes

- CG/ESG/Stewardship rating frameworks

- Support in the development and implementation of Environmental and Social Management Systems (ESMS) for infrastructure projects (PPP), aligned to international best standards

- Support in defining roles and responsibilities among stakeholders and guidance tools for implementation

Policy Makers

- Policy support on governance, stewardship and sustainability from the practitioner’s perspective

- CG and ESG thematic research

- Support in the formulation of governance, stewardship and sustainability standards and codes

- CG/ESG/Stewardship rating frameworks

- Support in the development and implementation of Environmental and Social Management Systems (ESMS) for infrastructure projects (PPP), aligned to international best standards

- Support in defining roles and responsibilities among stakeholders and guidance tools for implementation

Investment Professionals

- Stewardship, CG, corporate climate governance and sustainability in-person and blended learning courses

Investment Professionals

- Stewardship, corporate governance, corporate climate governance and sustainability in-person and blended learning courses

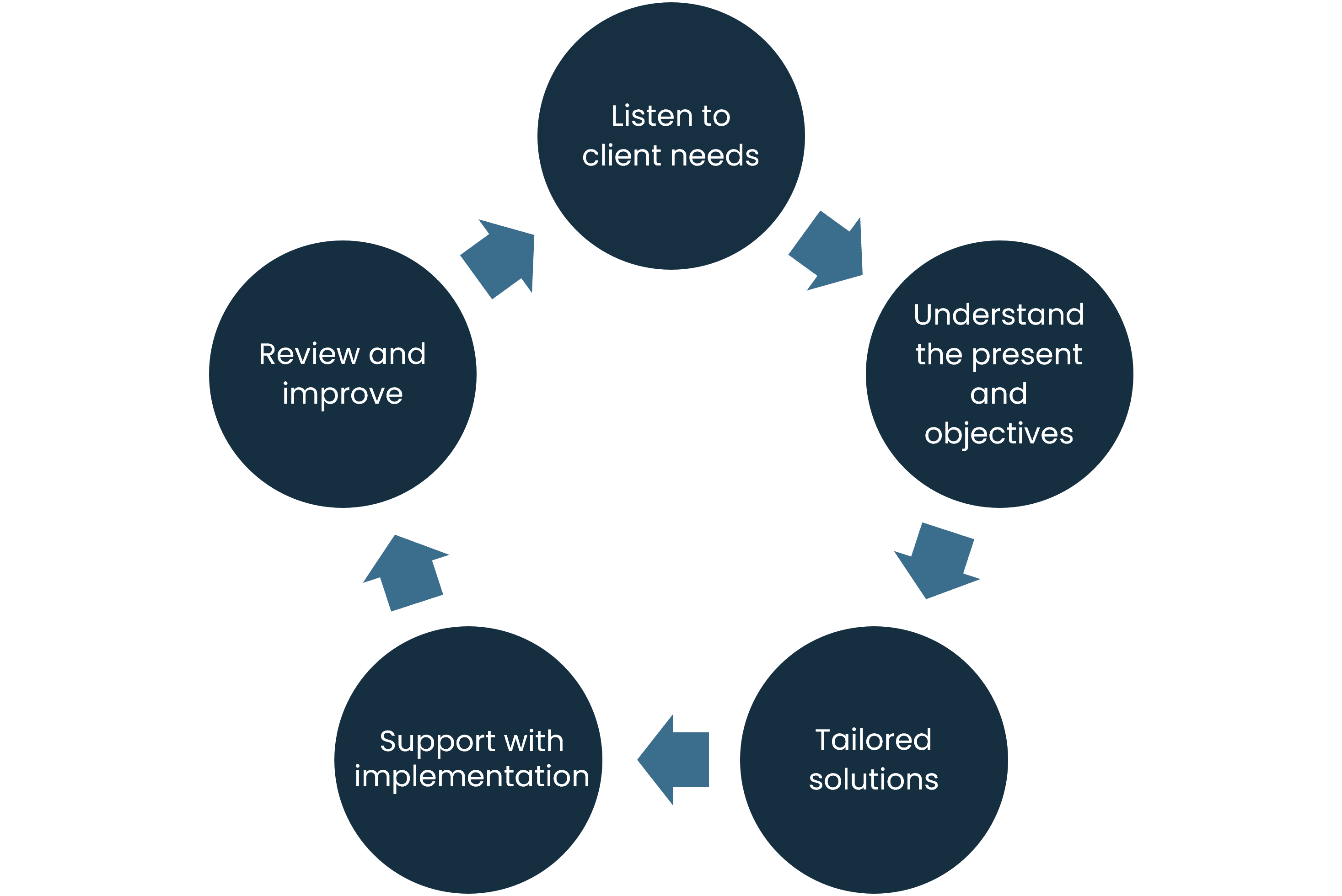

Our Process

We follow a rigorous and iterative process to ensure our services are tailored to clients’ needs, strategy and perspectives, following an engagement cycle leading to the mountaintop

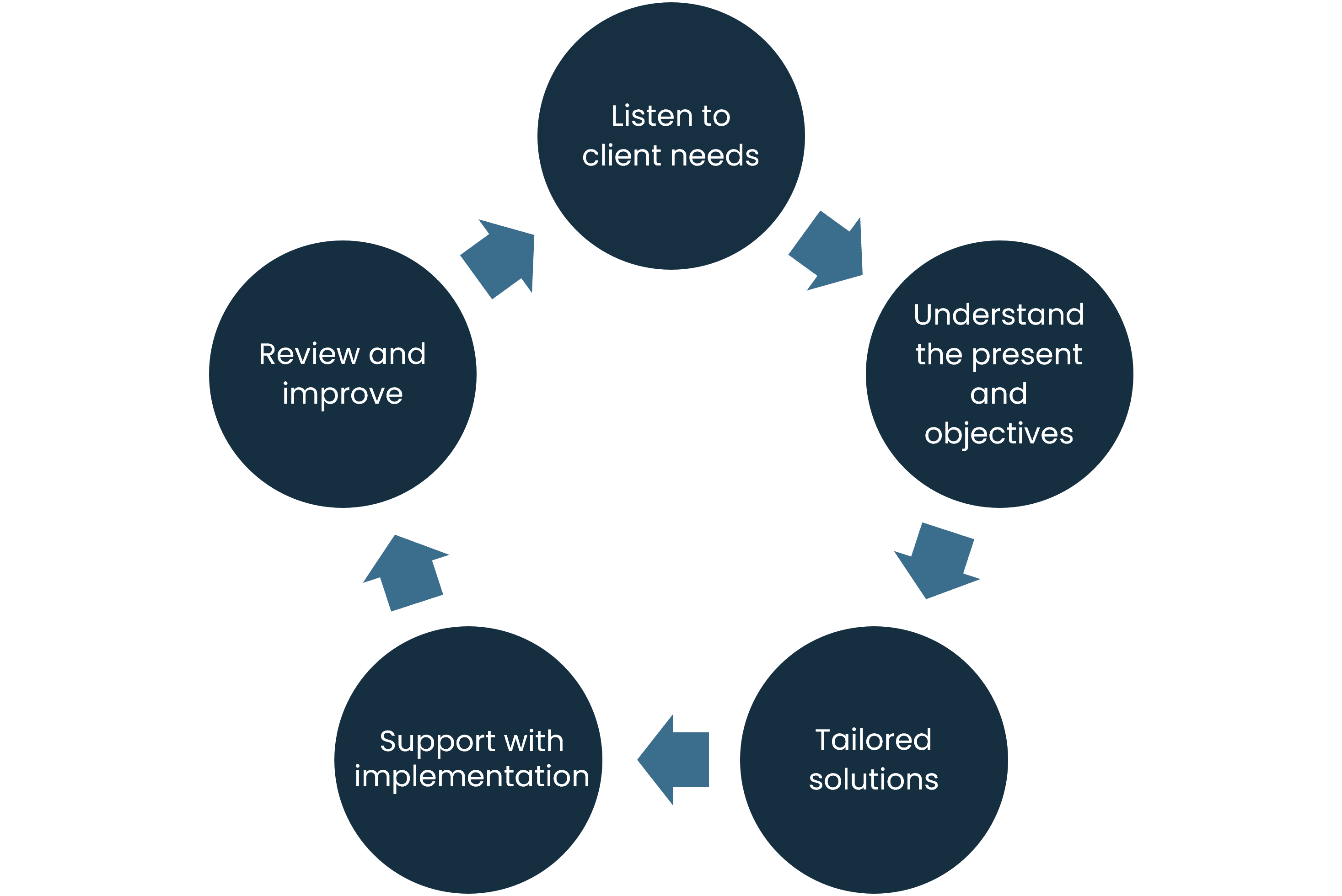

Our Process

We follow rigorous and iterative process to ensure our services are tailored to clients’ needs, strategy and perspectives, following an engagement cycle leading to the mountaintop